Management Discussion and Analysis

Employee Capital

In DFCC Bank’s quest to be the most customer centric bank in the country, having an engaged, empowered, agile workforce that is responsive to the requirements of customers is crucial.

The COVID-19 pandemic put to test the agility and responsiveness of the Bank’s workforce. However, the infrastructure and protocols in place ensured that the Bank was able to swiftly shift its staff to working remotely and apply social distancing where the physical presence of the staff was required.

The Bank continued to invest in the development and well-being of its employees, embracing the use of online platforms to facilitate training and maintain communication between staff members even while working from home. The Bank adheres to the highest standards of ethical practices and respects human rights when dealing with its employees, providing them with a diverse, safe, healthy, and equal opportunity working environment.

Workforce statistics

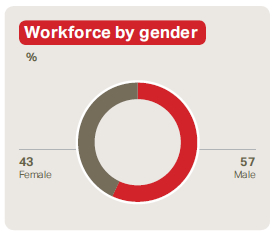

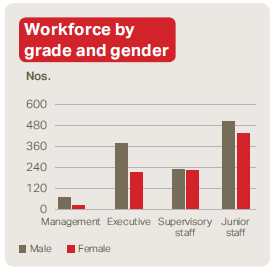

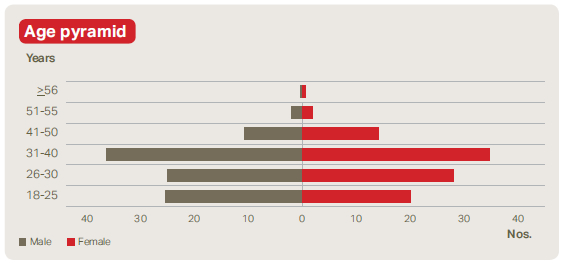

The Bank had 2,072 employees at the end of 2020 with 87% constituting the permanent cadre. Overall there was a marginal decline in headcount in comparison to the previous year. In terms of gender diversity, the male: female representation amounted to 57:43. Approximately 66% of employees within the branch network are based outside the Western Province. Approximately 62% of the workforce are in the age category of 26-40.

Further information can be found in the following statistical representations of the Bank’s workforce in 2020.

Workforce by province and gender

| Province | Number of branches |

Male | Female | Total |

| Central | 15 | 93 | 56 | 149 |

| Eastern | 10 | 55 | 21 | 76 |

| Northern | 6 | 33 | 21 | 54 |

| North-Central | 9 | 57 | 23 | 80 |

| North-Western | 11 | 60 | 45 | 105 |

| Sabaragamuwa | 15 | 69 | 38 | 107 |

| Southern | 23 | 104 | 76 | 180 |

| Uva | 9 | 54 | 23 | 77 |

| Western | 41 | 231 | 194 | 425 |

| Total | 139 | 756 | 497 | 1,253 |

| Number of units | Male | Female | Total | |

| Departments and other business units | 94 | 423 | 396 | 819 |

Resourcing

The Bank regularly takes part in a variety of events such as career fairs held at schools, universities, and educational institutes to highlight its positioning as an employer of choice. Internal initiatives such as staff-incentivised referral schemes are introduced from time to time to encourage the Bank’s employees to source applicants for the Bank’s talent pool.

Recruitment

During the year under review, arising from the business impact of the pandemic, a conscious effort was made to restrict recruitment. Some planned expansions and new positions were kept on hold while replacements too were accommodated on a case by case basis. During the year, 175 new employees were recruited of which 63% were to junior positions and approximately 77% of new recruits were under the age of 30.

Learning and development

The development and building of staff competencies are an ongoing focus of the Bank. Supervisors are expected to engage one-on-one with their staff and develop an individual development plan for every employee. Ensuring that this plan is executed is the combined responsibility of the individual, the supervisor, and the HR Department. After the training requirements are identified, an annual training plan is formulated for the Bank. The plan is based on the individual development plans as well as the strategic imperatives of the Bank. As the year was fraught with unexpected challenges, most of the training was conducted through virtual platforms.

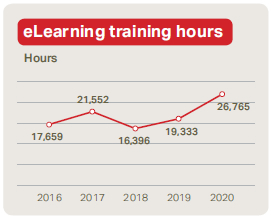

The Bank transitioned to a new eLearning platform, “eAcademy”, having used the previous platform for the past decade. The new platform offers great flexibility for content design and data management and has also enabled employees to access e-learning modules through their smartphones. During the year over 7,000 participants attended 323 programmes conducted virtually. Through the eLearning platform, 62 technical and soft skills modules were made available and regularly accessed by the staff with about 26,800 learning hours accumulated during the year.

| Number

of training courses |

Training participants |

|

| Online training | 323 | 7,057 |

| On-site programmes | 78 | 943 |

| eLearning modules | 62 | 19,228 |

| Total number of trainings |

463 | 27,228 |

Certification programmes and further education

Two certification programmes covering banking operations and credit are available to eligible staff. During the year under review, 101 employees participated in the operations certification programme, while 73 employees followed the credit certification course.

The Bank actively encourages its employees to pursue professional development by obtaining banking, professional, and postgraduate qualifications. The Bank assists employees through several grant and loan-based assistance schemes.

Career development

DFCC Bank operates multiple career development programmes that target individuals at different stages of career progression.

The “Ascension” programme aims to develop a high potential talent pool and groom employees to take on higher level roles through customised development plans, special assignments, enhanced job scopes, and specialised training.

The “Rise” programme is a voluntary programme aimed at individuals facing performance difficulties by assisting them in improving their capacity and productivity through a variety of mechanisms including one-on-one feedback sessions, role changes,and specialised training.

In line with the Bank’s emphasis on building a robust leadership pipeline, a new programme, “Nurturing Leaders to Greatness”, is currently being rolled out. Through this programme, 42 mid-level managers have been selected to undergo an intensive assessment and interview process. The top scoring employees will be recognised and awarded. All participants will be provided with a customised individual development plan which will identify strength areas for development, training requirements and other development initiatives to address the gaps.

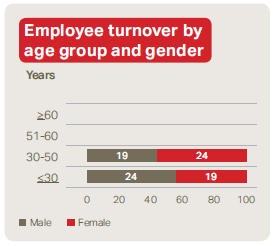

Employee retention and turnover

The Bank places high importance on employee satisfaction and retention as part of its human capital strategy. Multiple communication and grievance redressal mechanisms are in place, alongside extensive employee engagement activities such as competitions, awards programmes, extracurricular events, and comprehensive training and advancement programmes. The Bank reviews its human resource policies annually and revises them to align with the Bank’s strategic objectives, industry standards as well the needs of its employees, while ensuring transparency and equitability.

The Bank experienced limited turnover during the year, with a turnover rate of 4.9%. Despite the challenging business circumstances inflicted by the ongoing pandemic, the Bank was committed to ensure job security and reassure employees in this regard. The turnover can primarily be attributed to contract and sales staff, which generally tends to have a higher turnover rate. Exit interviews are conducted for departing staff members with feedback collated and provided to supervisors and remedial action taken, if necessary.

Communication

2020 saw several significant changes made to the way the Bank manages and communicates with its employees. Many of these changes are a part of the Bank’s Vision 2025 strategy to become a digital-first, customer centric bank. Due to the COVID-19 pandemic which saw a significant number of the Bank’s employees working from home and on a roster basis, the Bank’s plans were accelerated to accommodate the shift and ensure that employees could continue serving their customers uninterrupted.

The intranet allows employees to upload and react to photos, receive updated information on job vacancies within the Bank, view information on training programmes, and easily search for HR policies, regulatory and compliance guidelines, etc.

The “Listening Wall” is a digital platform which enables the Bank’s employees to express their ideas on a variety of topics including suggestions for process improvements and new products, as well as raise their concerns and issues. A committee reviews the ideas and issues raised on this platform on a monthly basis and takes necessary actions.

In 2020, the Bank transitioned to a new cloud-based HR Information System, “People’s HR”, to better serve its employees. Employees can now use an app to mark their attendance, even if they are not present at a physical location. The second phase of the HRIS implementation will take place in 2021 and introduce modules for performance management and automating the entire recruitment process, from resourcing to onboarding. The Bank also adopted Google Workspace as the new communications and productivity enhancement platform. Zoom was used as an additional communications platform to facilitate larger virtual meetings, such as the annual townhall meeting where the Bank’s CEO engages directly with the staff to address their queries and provides redressal to grievances raised.

Grievance management

The Bank has several grievance management methodologies in place that can be employed to address staff concerns. There is a Grievance Committee, comprising of a cross-functional team, which handles concerns raised by employees. The Reach Out Committee, also comprised of a cross-functional team, is dedicated to handling the concerns and grievances of the Bank’s female employees. The Bank implemented a new grievance workflow during the year that further empowers its employees. Employees now have access to multiple grievance management mechanisms and can choose how they want their grievances to be escalated and also decide who they would like to declare concerns to.

Stronger staff engagement

The Bank’s intranet, “WECONNECT”, was revamped to facilitate and accommodate increased engagement from staff.

Happiness and well-being

Health and safety during COVID-19

As banking was considered a critical activity during the lockdown periods, the Bank embarked on a massive endeavour, under very stringent timelines, almost overnight, to continue its operations in a safe and controlled manner. The staff were provided with secure VPN access to the Bank’s network, as well as laptops and other equipment as needed so they could work from home.

To allow for social distancing on the Bank’s premises, a roster system was introduced that helped to reduce the footfall across the Bank’s branches. Regular communications were made to the staff pertaining to protocols deployed, safety in the workplace, and best practices to be followed at home. Handwashing facilities and sanitisers were introduced across the branch network, along with mandatory facemask policies. The Bank also provided transport facilities for its staff to minimise the use of public transport.

Furthermore, the Bank focused on emphasising the importance of mental and physical wellness to employees through programmes on stress management and nutrition and wellness and various opportunities to participate in fitness classes conducted virtually were also made available during the lockdown periods. Employees were also provided with full or partial funding for gym memberships and social clubs. The Bank also offered multiple opportunities for socially distant engagement and interaction during the year.

Social event calendar in 2020

The Bank held a virtual interdepartmental talent contest wherein employees could form teams and showcase their talent and creativity. Over 50 teams across the Bank participated in the contest, which culminated in an awards ceremony. It was the first virtual event of its kind conducted by the Bank.

The Bank held its awards event in a mixed physical and virtual event, where the Bank’s staff could participate in the event via Zoom from their Bank branches or from their residence. Some of the other social engagement activities organised during the year included the following:

| Virtual Townhall meeting for all staff with CEO | July 2020 |

| Virtual Poson Bakthi Gee | July 2020 |

| Virtual interdepartmental contest | July 2020 |

| International Youth Day – Webinar on stress management and mindfulness | August 2020 |

| Virtual Zumba and fitness classes | August 2020 onwards |

| World Children’s Day – Virtual kids programme | October 2020 |

| 65th Anniversary and Annual Awards Ceremony | October 2020 |

| Monthly intranet quiz | November 2020 onwards |

| World Diabetes Day – Webinar | November 2020 |

| Virtual kids Christmas party | December 2020 |

| Virtual Christmas tree competition | December 2020 |

#TogetherWeGrow

The #TogetherWeGrow initiative was launched in 2019 and aims to build a one-team mindset among the Bank’s employees by motivating them to make a shift in their thinking and action. The initiative is driven primarily by the Bank’s millennial employees on a voluntary basis, seeking to create a positive, productive, and pleasant work culture that makes the Bank’s employees feel that they are taken care of and appreciated. The #TogetherWeGrow initiative was recognised by the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP) with a Merit Accolade under the Outstanding Development Project Awards for Human Capital Development at the 43rd ADFIAP Annual Meeting.

DFCC REDS

The DFCC REDS is a cross-functional team that has been active for the past decade. The team engages the Bank’s new staff by helping them to assimilate more easily into the Bank and its culture and people. DFCC REDS also empowers the Bank’s young staff by providing them with a platform where they can bring up ideas and issues and have a collective voice with which to present them.

During the year under review, the REDS organised a virtual quiz event, the first of its kind at the Bank. Despite the logistical and technological challenges of an undertaking of this nature, the team successfully executed the event.

DFCC Bank uplifts its communities

The DFCC Community Projects Team, Sustainability Unit, and HR Department, regularly organise events to contribute to the upliftment of our communities.

During the year, through staff contributions, donations were made to projects initiated for Children’s Day and International Women’s Day. The Bank continued its commemorative staff tree planting campaign for the fourth consecutive year and teamed up with Caritas Sri Lanka – SEDEC to launch a scholarship programme to provide financial assistance for the youth of vulnerable, low-income families. The five-year programme will help at least 100 recipients to continue their education uninterrupted with a focus on entrepreneurship.

The Bank also actively supports its employees through provision of extended paid leave and financial assistance for medical emergencies.

Equal opportunity, diversity, and inclusion

DFCC Bank continuously advocates and champions a diverse and inclusive environment. Recruitment processes are transparent and equitable with emphasis on selection of the best talent irrespective of gender, cast, creed or religion. Opportunities are offered to employees based on their performance and aptitude without discrimination. Equitable treatment for all employees is a constant priority of the Bank and is reflected in its promotion data and the remuneration comparator data in the following table.

| Grade | Basic salary ratio (Male:Female) |

| Management | 48:52 |

| Executive | 50:50 |

| Supervisory staff | 50:50 |

| Junior staff | 50:50 |

| Total | 49:51 |

The Bank also provides permanent and contractual employment opportunities to differently abled persons based on their capacities and competencies, in line with the Bank’s stance on inclusivity.

Collective bargaining

DFCC Bank takes the concerns and grievances of its employees seriously. Employees can utilise multiple avenues of communication to present their concerns to the Bank. A new grievance escalation methodology and workflow was implemented during 2020, further empowering the Bank’s employees. The Bank also maintains an open-door policy, allowing employees to raise their concerns directly with any member of the Senior Management, including the CEO and Chairman. Due to the open nature of communication between the Bank and its employees and the swift addressal of any issues, there has not been a need to establish any collective agreements.

Benefits

Benefits are reviewed from time to time and revised in line with industry practices and internal equities. The following table lists the benefits provided to full-time employees which are not provided to contract, temporary, or part-time employees.

| Employment type | Housing loan | Vehicle loan* | Exam* | Professional subscription* |

Social Club gymnasium* |

Miscellaneous/ Staff loan |

Festival advance** |

MBA loan | Holiday| grant*** |

| Permanent | √ | √ | √ | √ | √ | √ | √ | √ | √ |

| Contract | x | x | x | x | x | x | x | x | x |

* Also provided to Executive Trainees and Management Trainees on fixed term contracts.

** Only for non-executive staff.

*** Based on the offer of employment, may also be provided to contract staff.