Business Model

Operating Environment

Global economy

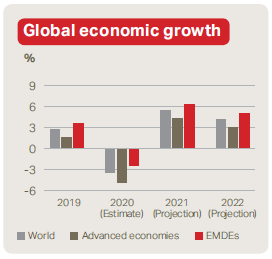

The COVID-19 global pandemic led to a global recession, the likes of which have not been seen since the Great Depression and the two World Wars of the 20th century. It has led to a significant human toll, negatively impacted small businesses, and worsened inequality. Although global economic activity started recovering after the initial lockdowns were lifted in the middle of the year, the continued spread of the virus led to more lockdowns later in the year and moderated economic activity. Projections by the International Monetary Fund (IMF) indicate that the global economy declined by 3.5% in 2020. Advanced economies contracted by 4.9%, while emerging market and developing economies (EMDEs) contracted by 2.4%. However, the performance of EMDEs is primarily due to China’s exceptional rebound, whereas the rest of the EMDEs were impacted by continuing outbreaks and slower recoveries.

Source: World Economic Outlook Update – January 2021, International Monetary Fund

Uncertainty continues to linger over 2021. With the approvals for multiple vaccines and the rollout of vaccination campaigns in certain countries, the IMF projects a 5.5% recovery in the global economy. Although economic activity appears to be adapting to the new normal, the rise of new variants of the COVID-19 virus followed by lockdowns and logistical difficulties with vaccine distribution continue to pose risks to pandemic recovery efforts. Major central banks are expected to maintain their current policy stances to support economic recovery, which would result in advanced economies largely remaining at their current levels while EMDEs gradually improve.

Sri Lankan economy

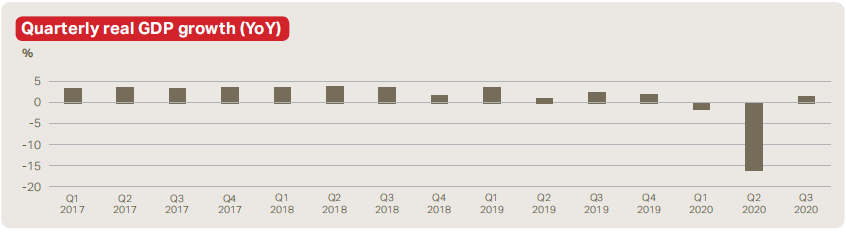

The Sri Lankan economy has been largely susceptible to political instability in recent years, while the Easter Sunday attacks took a great toll on the economy in 2019. Although the economy started to recover in the latter part of 2019, the COVID-19 pandemic brought an abrupt halt to that momentum as the Government took measures to control the spread of the virus. The country experienced capital outflows, exchange rate depreciation, and increased pressure on government finances. This led to the economy shrinking by 16.3% in Q2, its largest drop in history. Economic activity returned to positive growth for the first time in the year in Q3 at 1.5% as businesses adapted to the new normal and the Agriculture, Industry, and Services sectors reported positive growth.

The Central Bank of Sri Lanka (CBSL) expects the Sri Lankan economy to have contracted by 3.9% in 2020, whereas the IMF has projected a 4.6% contraction. Although tourism and financial inflows were significantly dampened by the pandemic, the external sector was boosted by workers remittances surpassing USD 7 Bn. and restrictions imposed on imports. The country’s official reserves were maintained at USD 5.7 Bn by the end of the year.

Source: Central Bank of Sri Lanka

The banking sector

The Sri Lankan banking sector was well positioned in capital and liquidity at the start of 2020 due to the implementation of international best practices and regulatory requirements that required banks to establish buffers to maintain adequate levels of capital and muted credit growth leading to excess liquidity.

An expansion of credit was recorded in the sector but was primarily driven by increased loans and advances to the Government and State-Owned Enterprises (SOEs). Rupee deposits increased significantly during the nine months ended September 2020 and were the major source of funding for the sector. Deposits continued to grow during the pandemic, with rupee deposit growth increasing from 7.7% YTD September 2019 to 19.3% YTD September 2020 and foreign currency deposit growth increasing from 14.0% to 14.3% during the same period. Credit growth declined in comparison to deposit growth, with the credit to deposit ratio falling to 84.8% in September 2020 from 88.2% in December 2019.

However, despite the debt moratorium provided to businesses and individuals affected by the COVID-19 pandemic, the increase in non-performing loans (NPLs) poses a credit risk to the banking sector and the full impact of the pandemic on asset quality is yet to be determined. Without appropriate remedial actions being taken, the solvency and liquidity of the sector may come under pressure.

Outlook

The CBSL remains bullish on the Sri Lankan economy in 2021, anticipating a strong growth of approximately 5-6%. The performance of the country’s sovereign bond yields and stock market indices indicates increased confidence from domestic investors in the Sri Lankan economy. Moreover, tourism and financial inflows are expected to pick up in 2021 as the country reopens its borders. Lending rates are expected to continue their decline from 2020 as a result of the excess liquidity in the domestic money market. The CBSL has stated that it will continue its accommodative monetary policy stance to continue the momentum in the economy’s recovery. Along with the incentives being offered for capital investment, the low interest rate regime currently in place is expected to improve economic growth prospects and support debt consolidation efforts. Furthermore, the CBSL expects inflation to remain within the targeted range of 4-6% over the medium-term, although external factors such as an increase in global petroleum prices or pressures from domestic supply-side factors could pose inflation risks.